【答案】《金融学基础》(电子科技大学)章节作业期末慕课答案

金融的概念

1.判断题:The roles of time and conditions of uncertainty are the two distinguishing characteristics of financial decisions.

选项:

A、正确

B、错误

答案:【正确】

个人/家庭和企业的金融决策

1.单选题:A business firm’s decision between financing the purchase of a delivery van by taking out a loan or by leasing is an example of ( )

选项:

A、capital-budgeting decision

B、working capital management decision

C、capital structure decision

D、risk management decision

答案:【capital structure decision】

2.单选题:In order to protect against a drop in price of the stocks you hold, you decide to lock in stock prices by signing a contract with financial intermediaries. What is the type of financial decision you make in the example? ( )

选项:

A、Consumption and saving decision

B、Investment decision

C、Financing decision

D、Risk-management decision

答案:【Risk-management decision】

金融系统中资金的流动

1.单选题:Suppose that Alice bought a house by obtaining a loan from a financial company, which raised funds by issuing stocks and bonds in the markets. Which one is correct about the flow of funds? ( )

选项:

A、Surplus Units - Markets - Deficit Units

B、Surplus Units - Markets - Intermediaries - Deficit Units

C、Surplus Units - Intermediaries - Deficit Units

D、Surplus Units - Intermediaries - Markets - Deficit Units

答案:【Surplus Units - Markets - Intermediaries - Deficit Units】

金融市场的类型

1.判断题:Stock is one of the financial instruments traded on the money market.

选项:

A、正确

B、错误

答案:【错误】

《模块一:金融和金融系统》单元作业

《模块一:金融和金融系统》单元测验

1.单选题:一家企业正在决策是通过融资租赁还是银行贷款来购买设备的决策属于( )

选项:

A、资本预算决策

B、营运资本管理决策

C、资本结构决策

D、风险管理决策

答案:【资本结构决策】

2.单选题:为了防止手头外汇产品的价格下跌,你与一家金融中介签订合同锁定将来的汇率。你的决策属于( )

选项:

A、消费与储蓄决策

B、投资决策

C、融资决策

D、风险管理决策

答案:【风险管理决策】

3.单选题:每份美国国债的面值高达$100,000,现有一位投资者拟将手头的$1,000投资于美国国债。然而,由于$1,000的资金不足以让该投资者参与国债交易,于是,该投资者以每份$10的价格,购买了100份的专门投资美国国债的共同基金。该例中,共同基金主要发挥了( )的金融系统功能。

选项:

A、提供信息

B、集合资源和分割股份

C、支付和结算

D、处理激励问题

答案:【集合资源和分割股份】

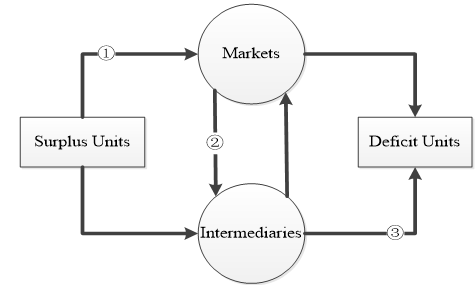

4.单选题:在金融系统中,以下哪种活动的资金流动顺序按照图示①—②—③ 的顺序进行? ( )

选项:

A、你购买一份保险,而后保险公司将保费收入投资于国债

B、你购买中国建设银行发行的债券,建行利用发行所得发放贷款

C、你购买国债

D、你将资金存入银行,而后银行将其作为贷款发放

答案:【你购买中国建设银行发行的债券,建行利用发行所得发放贷款】

5.单选题:通常而言,下列不属于投资银行主要业务的是( )

选项:

A、承销证券

B、帮助企业公开上市

C、兼并收购

D、吸收存款和发放贷款

答案:【吸收存款和发放贷款】

6.单选题:下列说法错误的是 ( )

选项:

A、金融机构和金融市场的存在方便了人们在时间和风险维度上资源的配置

B、金融学是研究人们如何在不确定环境进行稀缺资源配置的一门学问

C、通常而言,人们可以准确估计某个投资项目未来的成本和收益

D、金融系统包括金融市场、金融中介、金融服务公司和监管机构等

答案:【通常而言,人们可以准确估计某个投资项目未来的成本和收益】

7.单选题:因资本结构领域的突出贡献而被授予诺贝尔经济学奖的学者是( )

选项:

A、Merton H. Miller

B、Harry M. Markowitz

C、Robert C. Merton

D、Eugene F. Fama

答案:【Merton H. Miller】

8.单选题:关于“余额宝”,下列正确的说法是( )

选项:

A、是货币市场的一种理财产品

B、7日年化收益率5%,是一年定期存款利率2.5%的两倍

C、随时可“支取”,相当于活期存款

D、可以像买卖股票一样在股票交易软件中交易

答案:【是货币市场的一种理财产品】

9.多选题:商业银行之间通常可以通过( )进行短期的资金融通

选项:

A、股票市场

B、回购市场

C、同业拆借

D、票据转贴现

答案:【回购市场#同业拆借#票据转贴现】

10.多选题:以下获得诺贝尔经济学奖的是( )

选项:

A、Harry Markowitz

B、Myron Scholes

C、Fisher Black

D、Robert Merton

答案:【Harry Markowitz#Myron Scholes#Robert Merton】

11.判断题:金融决策往往涉及跨时期和不确定环境下的决策

选项:

A、正确

B、错误

答案:【正确】

12.判断题:股票是货币市场的一种金融产品。

选项:

A、正确

B、错误

答案:【错误】

13.判断题:银行通常不愿意给无法提供抵押品的潜在贷款申请者提供贷款,这属于一种道德风险行为

选项:

A、正确

B、错误

答案:【错误】

14.判断题:通常而言,未对信用贷款申请者进行信用记录审核的银行更加可能吸引到低质量的高风险客户,这反映了信贷过程中的“逆向选择”问题。

选项:

A、正确

B、错误

答案:【正确】

15.判断题:一旦购买健康保险,投保者更加不注意自己的身体健康,这属于一种逆向选择

选项:

A、正确

B、错误

答案:【错误】

16.判断题:金融系统中,资金的流动必定伴随着风险的转移

选项:

A、正确

B、错误

答案:【错误】

17.判断题:现代企业制度下,企业经营的目标是最大化公司利润

选项:

A、正确

B、错误

答案:【错误】

18.判断题:通常而言,由于道德风险问题的存在,高质量的二手车并不倾向通过二手车市场来出卖

选项:

A、正确

B、错误

答案:【错误】

19.判断题:对二级市场的投资者而言,企业上市前的财务报表造假行为,属于一种逆向选择风险。

选项:

A、正确

B、错误

答案:【正确】

20.判断题:中央银行减少国债逆回购可视作宽松货币政策的一种公开市场操作

选项:

A、正确

B、错误

答案:【错误】

21.判断题:发行同业存单属于商业银行的一项负债业务。

选项:

A、正确

B、错误

答案:【正确】

22.判断题:证监会对上市前公司进行严格审核,是降低投资者遭受逆向选择风险的一种手段

选项:

A、正确

B、错误

答案:【正确】

23.判断题:第三方支付公司挪用客户备付金的行为属于一种逆向选择风险。

选项:

A、正确

B、错误

答案:【错误】

24.判断题:本币贬值是减少本国贸易逆差的一种手段。

选项:

A、正确

B、错误

答案:【正确】

25.判断题:当日可申购和赎回的货币基金,其本质相当于活期存款。

选项:

A、正确

B、错误

答案:【错误】

26.判断题:投资者被P2P网贷平台“自融自用”性质的虚假借款项目而遭受的风险,属于一种逆向选择风险。

选项:

A、正确

B、错误

答案:【正确】

单利、复利等基本概念

1.单选题:Suppose you put $1,000 into an account earning an interest rate of 5% per year for 5 years, and assuming you take nothing out of the account before then. What is the future value? What are the simple interest and the compound interest?

选项:

A、FV=$1,376.28; simple interest=$350; compound interest=$26.28

B、FV=$1,226.28; simple interest=$200; compound interest=$26.28

C、FV=$1,276.28; simple interest=$250; compound interest=$26.28

D、FV=$1,279.28; simple interest=$250; compound interest=$29.28

答案:【FV=$1,276.28; simple interest=$250; compound interest=$26.28】

复利、计息频率与有效年利率

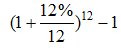

1.单选题:You take out a loan at an APR (annual percentage rate) of 12% with monthly compounding. What is the effective annual rate on your loan?

选项:

A、13.68%

B、12.98%

C、13.98%

D、12.68%

答案:【12.68%】

2.单选题:Suppose a $10,000 T-bill that will mature in 3 months is currently selling for $9,800. If you purchase and hold the T-bill to maturity what rate of return would you earn on this investment computed as a continuously compounding annual rate (over the 3-month period)?

选项:

A、8.181%

B、8.081%

C、9.011%

D、8.053%

答案:【8.081%】

个人生命周期财务规划

1.单选题:Georgette is currently 30 years old, plans to retire at age 65 and to live to age 85. Her labor income is $25,000 per year, and she intends to maintain a constant level of real consumption spending over the next 55 years. Assume no taxes, no growth in real salary, and a real interest rate of 3% per year. What is the value of Georgette’s human capital? And what is her permanent income?

选项:

A、$547,180.50; $20,063.19

B、$537,180.50; $20,063.19

C、$537,180.50; $20,763.19

D、$537,190.50; $20,163.19

答案:【$537,180.50; $20,063.19】

资本预算决策与净现值法则

1.单选题:You are taking out a $100,000 mortgage loan to be repaid over 25 years in 300 monthly payments. (a) If the interest rate is 16% per year what is the amount of the monthly payment?(b) If you can only afford to pay $1000 per month, how large a loan could you take? (c) If you can afford to pay $1500 per month and need to borrow $100,000, how many months would it take to pay off the mortgage?(d) If you can pay $1500 per month, need to borrow $100,000, and want a 25 year mortgage, what is the highest interest rate you can pay?

选项:

A、(a) $1358.89; (b) $73,590; (c) 166; (d) 1.582% per month

B、(a) $1368.89; (b) $73,590; (c) 176; (d) 1.482% per month

C、(a) $1358.89; (b) $75,590; (c) 166; (d) 1.482% per month

D、(a) $1358.89; (b) $73,590; (c) 166; (d) 1.482% per month

答案:【(a) $1358.89; (b) $73,590; (c) 166; (d) 1.482% per month】

净现值与内部报酬率的计算

1.单选题:As CEO of ToysRFun, you are offered the chance to participate, without initial charge, in a project that produces cash flows of $5,000 at the end of the first period, $4,000 at the end of the next period and a loss of $11,000 at the end of the third and final year. (a)What is the net present value (NPV) if the relevant discount rate (the company’s cost of capital) is 10%? (b)What is the internal rate of return (IRR)?

选项:

A、(a) -$423.22; (b) 13.6%

B、(a) -$413.22; (b) 12.6%

C、(a) -$413.22; (b) 13.6%

D、(a) -$403.22; (b) 13.9%

答案:【(a) -$413.22; (b) 13.6%】

PC1000项目

1.单选题:Suppose you are a manager in the personal computer division of Compusell Corporation, a large firm that manufactures many different types of computers. You come up with an idea for a new type of personal computer, which you call the PC1000. Your estimates assume that sales will be 4,000 units per year at a price of $5,000 per unit. The total fixed costs are $3,500,000 per year, in which the depreciation is $400,000. The variable costs are $4,000 per unit for the PC1000. The corporate income tax rate is 40% per year. The initial outlay for PC1000 is $5,000,000 and an additional $2,200,000 you will get back at the end of the project’s life in year 7. The rate used to discount the cash flows is 15%. What would be the NPV of the PC1000 project?

选项:

A、-$1,260,845

B、-$1,360,645

C、-$1,270,645

D、-$1,260,645

答案:【-$1,260,645】

2.单选题:Suppose you are a manager in the personal computer division of Compusell Corporation, a large firm that manufactures many different types of computers. You come up with an idea for a new type of personal computer, which you call the PC1000. The initial outlay for PC1000 is $5,000,000. The total fixed costs are $3,500,000 per year, in which the depreciation is $400,000. The variable costs are $3,750 per unit for the PC1000. Your estimates assume that the price of the personal computer is $5,000 per unit. The corporate income tax rate is 40% per year. And an additional $2,200,000 you will get back at the end of the project’s life in year 7.What would be the break-even volume for the PC1000 project if the cost of capital is 25% per year?

选项:

A、4,281

B、4,181

C、4,151

D、4,256

答案:【4,181】

《模块二:跨时期优化:时间价值与折现现金流分析》单元作业

《模块二:跨时期优化:时间价值与折现现金流分析》单元测验

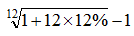

1.单选题:假设挂牌年利率(Stated Annual Percentage Rate, Stated APR)为12%,那么,每个月复利计息一次对应的有效年利率(Effective Annual Rate, EFF)为( )

选项:

A、

B、12%

C、

D、以上均不正确

答案:【 】

】

2.单选题:按照6%的年利率(1年计息一次),4年后收到的$100 的现值为( )

选项:

A、$126.25

B、$100

C、$79.21

D、$61.8

答案:【$79.21】

3.单选题:假设你今年和明年分别向银行存入$1000和$2000 。那么,按照10%的年利率(一年计息一次),两年后你的账户余额为( )

选项:

A、$3000

B、$3210

C、$3200

D、$3410

答案:【$3410】

4.单选题:假设你办理了本金为$1000 、年利率为 12%(月利率1%)的一笔分期付款,分12个月等额本息偿还。那么,你每月需要偿还的金额为( )

选项:

A、$88.85

B、$90.25

C、$86.25

D、$87.25

答案:【$88.85】

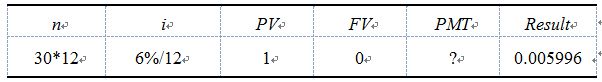

5.单选题:假设你通过30年期按揭贷款¥1,000,000购买了商品房一套,30年期按揭贷款的年利率为6%。已知“现值/年金系数”如下表(PV、FV和PMT分别为现值、终值和年金,Result即为“现值/年金系数”): 那么,“等额本息”和“等额本金”两种还款方式下,你第1个月的月供还款额分别为( )

那么,“等额本息”和“等额本金”两种还款方式下,你第1个月的月供还款额分别为( )

选项:

A、¥5,996和¥7,778

B、¥5,996和¥2,778

C、¥7,778和¥5,996

D、¥7,778和¥2,778

答案:【¥5,996和¥7,778】

6.单选题:AAA公司正在考虑支付$600,000购买一台设备。该设备的寿命期为7年,每年可以为公司节约$70,000,每年的维护成本为$15,000,采用直线折旧法的残值为$60,000(第7年末,残值处置收入需缴纳所得税)。此外,该设备投入使用还需一次性地垫付$20,000净营运资本。假设公司所得税率为35%,那么该设备未来7年内各年的增量现金流依次为( )

选项:

A、-$600,000 $82,750 $82,750 $82,750 $82,750 $82,750 $82,750 $162,750

B、-$600,000 $62,750 $62,750 $62,750 $62,750 $62,750 $62,750 $101,750

C、-$620,000 $62,750 $62,750 $62,750 $62,750 $62,750 $62,750 $121,750

D、-$580,000 $62,750 $62,750 $62,750 $62,750 $62,750 $62,750 $49,750

答案:【-$620,000 $62,750 $62,750 $62,750 $62,750 $62,750 $62,750 $121,750】

7.判断题:复利即为利息的利息

选项:

A、正确

B、错误

答案:【正确】

8.判断题:如果一年只计息一次,那么有效年利率即为挂牌年利率

选项:

A、正确

B、错误

答案:【正确】

9.判断题:住房按揭贷款即为年金的一种形式

选项:

A、正确

B、错误

答案:【正确】

10.判断题:如果你租车1年,每月的租金为1000元,那么你一年的租金即为12000元

选项:

A、正确

B、错误

答案:【错误】

11.判断题:利用NPV方法评估特定项目时,机会成本(或折现率)是其余所有投资机会回报率的平均值

选项:

A、正确

B、错误

答案:【错误】

相关答案

- 1. 【答案】《汇编语言程序设计》(电子科技大学)章节作业期末慕课答案

- 2. 【答案】《数学实验》(电子科技大学)章节作业期末慕课答案

- 3. 【答案】《电子技术实验基础(一:电路分析)》(电子科技大学)章节作业期末慕课答案

- 4. 【答案】《数据库原理及应用》(电子科技大学)章节作业期末慕课答案

- 5. 【答案】《数学建模》(电子科技大学)章节作业期末慕课答案

- 6. 【答案】《遥感原理》(电子科技大学)章节作业期末慕课答案

- 7. 【答案】《经济学》(电子科技大学)章节作业期末慕课答案

- 8. 【答案】《管理学》(电子科技大学)章节作业期末慕课答案

- 9. 【答案】《摄影基础》(电子科技大学)章节作业期末慕课答案

- 10. 【答案】《微积分(二)》(电子科技大学)章节作业期末慕课答案

热门答案

热门答案

- 1. 【答案】《概率论与数理统计》(电子科技大学)章节作业期末网课答案

- 2. 同一个定时器使用PWM输出模式时,可以利用输出通道输出多个PWM信号,这些PWM信号的周期和占空比都可以不同。

- 3. 【答案】《大学物理学II》(电子科技大学)章节作业期末网课答案

- 4. 同一个定时器可以利用输出通道输出多个PWM信号,这些PWM信号的周期和占空比都可以不同。

- 5. 【答案】电子技术应用实验2(数字电路综合实验)电子科技大学章节作业网课答案

- 6. 【期末】《数字信号处理》(电子科技大学)期末测试网课答案

- 7. 【期末】基于STM32CubeMX和HAL驱动库的嵌入式系统设计(电子科技大学)期末网课答案

- 8. 以下关于ARM处理器流水线的描述,不正确的是?

- 9. 下面不属于微控制器最小系统(狭义)的电路单元是

- 10. 【期末】《激光原理与技术》(电子科技大学)期末测试网课答案